The Challenges

If you are currently retaining 100% of your profitable customers, then no need to read further. If, however, you are like most carriers that are looking to enhance the timing and quality of your customer interactions, then you've come to the right place. As we all know, a small increase in customer retention rates can add millions to premium revenue, while also driving positive brand experience and even customer referrals.

Unfortunately, for many consumers that purchase insurance products or financial instruments, interaction with the agent or advisor is often limited to closing the sale and policy issuance. Then poof, the agent is gone only to reappear the day of or after a policy lapses. In this scenario, what's the likelihood the agent is going to send a birthday card, a happy anniversary email, I appreciate your business thank you card, or periodic educational materials that reinforce that the consumer made the appropriate decision to buy, and buy from you?

The reality is that your best agent is a hunter, not a nurturer. Commonly, an agent doesn't have time, inclination or the organizational structure to proactively send nurturing messaging. Historically, an agent also hasn't had the marketing tools available that, without manual intervention, trigger professional, personalized messaging to engage with each customer and maximize his/her book of business potential.

The Package

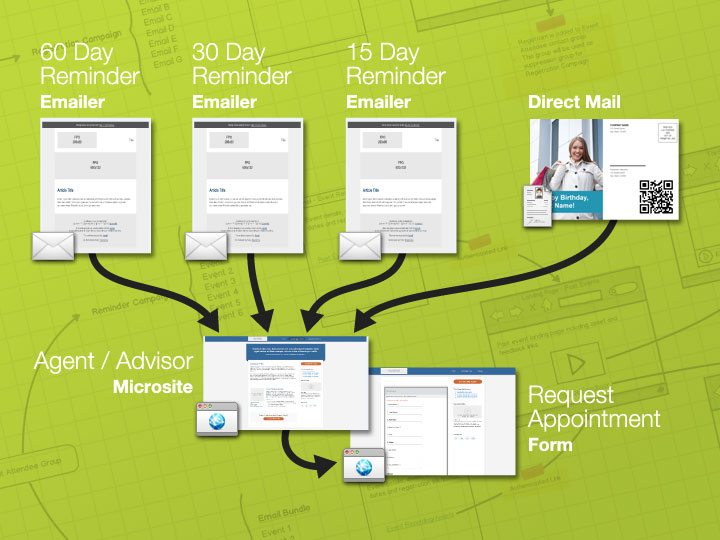

Distribion's customer retention programs focus on customer engagement to minimize policy lapses and customer disaffection. Distribion's Contact Manager can store important customer database fields like policy expiration date, customer birthday/anniversary and other important customer/policy profile information that, when properly utilized, automates the process of sending nurture messages to customers across both online and offline communications channels like email, direct mail and more.

As with all of Distribion's program deployments, customers not only gain a firm understanding how to leverage the Distributed Marketing Platform to create and deploy integrated, multi-part marketing messaging campaigns using best practices methodologies, but more importantly, generate results in weeks, not months.

The Results

Who wouldn't want to increase policy renewal rates while dramatically reducing the effort involved with retaining your profitable customers? What would a 1% increase in policy renewal rates mean to your top line? Increased marketing efficiency while reducing cost per touch point rings true for all marketing organizations faced with budget reductions and staffing levels. Throw in brand and regulatory compliance and minimum IT support needed to pull it off... Don't delay, contact Distribion today.

|

Ready to get started? Request a demo or sign up for a Quick Start trial!

|

Find out more!

|